Choosing between buying a home and renting one is a major financial and lifestyle decision. Both options come with clear advantages and trade‑offs, and the right choice often depends on your goals, stability, income, and long‑term plans. Below is a balanced look at the key factors to help you make an informed decision.

Buying

Purchasing a home requires a significant upfront investment—typically a down payment, closing fees, and ongoing maintenance costs. However, monthly mortgage payments contribute to building equity, which can be a valuable long-term asset.

* Pros

- Builds long-term wealth

- Potential for property value appreciation

- Stability in monthly payments (especially with fixed-rate loans)

* Cons

- High upfront cost

- Property taxes, repairs, and maintenance

- Reduced financial flexibility

Renting

Renting requires far upfront cash—usually just a deposit and first month’s rent. This makes it more accessible for individuals who need flexibility or are not ready for the financial responsibility of a mortgage.

* Pros

- Lower initial costs

- Freedom to relocate easily

- No responsibility for major repairs

* Cons

- No equity gained

- Rent can increase over time

- Limited ability to customize the living space

Buying

Owning a home provides long-term stability. You can decorate, renovate, or modify the property as you wish. This makes buying ideal for people who want to settle down or prefer a predictable environment.

Renting

Renting offers flexibility—perfect for those who expect job changes, are uncertain about their long-term plans, or prefer not to be tied to a single location.

Your local real estate market heavily influences this decision. In some areas, it may be cheaper to buy, especially with low interest rates. In high-demand urban areas, renting may be more affordable while still offering convenience.

4. Lifestyle Considerations

Buying is better if you:

- Plan to stay for 5 years or more

- Want greater control over your home environment

- Prefer stability and predictability

Renting is better if you:

- Move frequently

- Want fewer responsibilities

- Are still building savings

Buying a property can be a strong long-term investment, especially in growing cities. Over time, real estate can appreciate in value and even generate rental income if converted into an investment property. However, not all markets grow at the same pace, and property values can also decrease—so it’s not risk-free.

There is no one-size-fits-all answer to the buying vs. renting debate. The best choice depends on your financial situation, future plans, and personal priorities. If you value stability and ownership, buying may be your best option. If you prioritize flexibility and lower upfront costs, renting could be the smarter move.

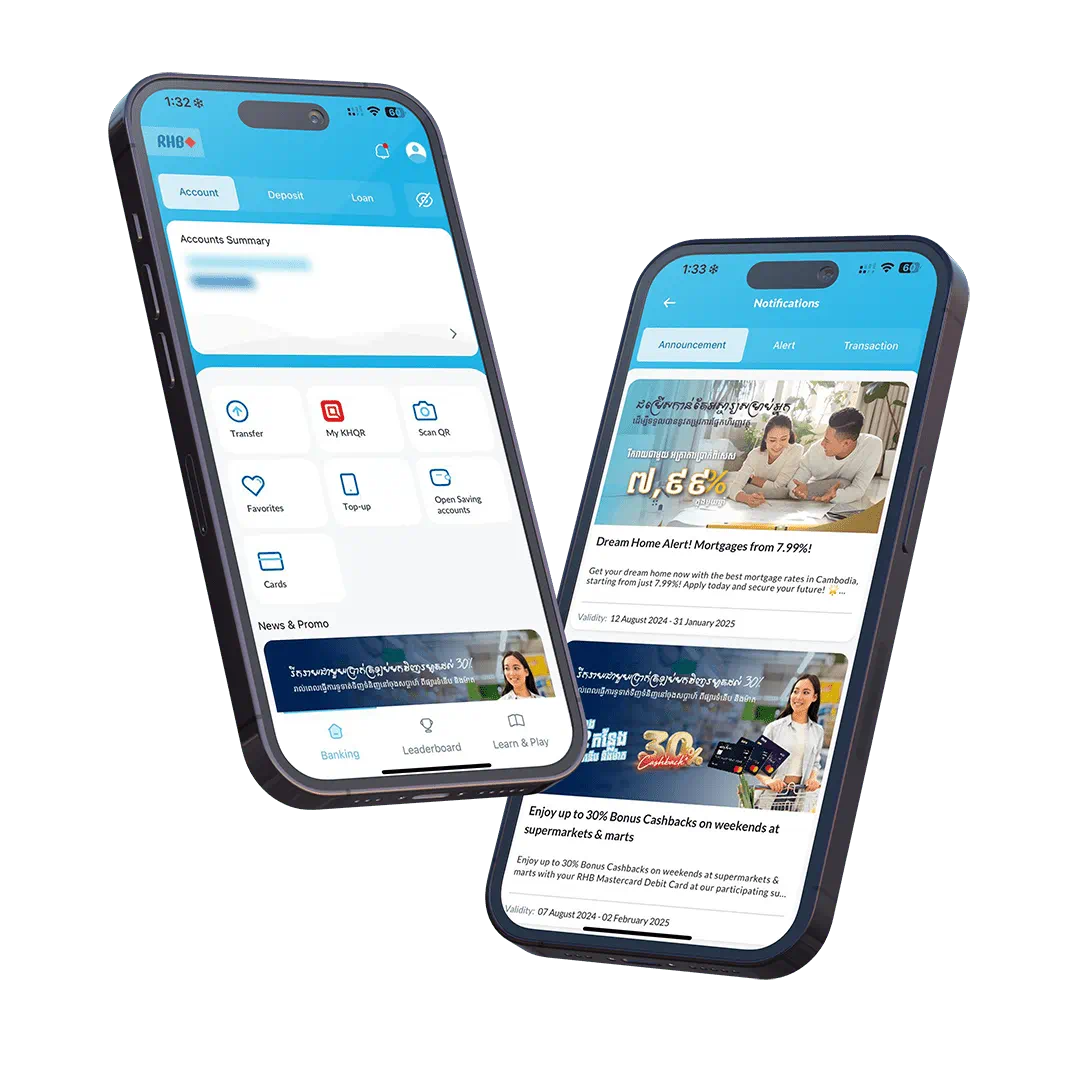

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!