Starting a business often requires capital, and for many aspiring entrepreneurs, borrowing money may seem like the only option. But is taking out a loan to kick-start your business really a wise decision? The answer depends on your financial preparedness, risk appetite, and the nature of your business.

Borrowing money can give you the capital you need to launch quickly, invest in equipment, hire staff, or secure a location. It allows you to maintain full ownership of your business while still gaining access to essential resources. If your business plan is solid and you anticipate steady income, repaying the loan may not be a major issue.

On the flip side, loans come with repayment obligations—regardless of whether your business makes a profit. High-interest rates and fixed repayment schedules can put pressure on your cash flow, especially in the early stages when revenue is still uncertain. Defaulting on a loan could also hurt your credit score and future borrowing ability.

Before you apply for a business loan, ask yourself:

If borrowing feels too risky, consider other paths. You could start small with personal savings, look for business grants, or explore crowdfunding platforms. Some entrepreneurs even begin part-time to reduce financial strain.

In conclusion, borrowing money to start a business can be a smart move if done carefully. But it’s not the only way. Evaluate your options, weigh the risks, and choose a path that aligns with your financial situation and business goals.

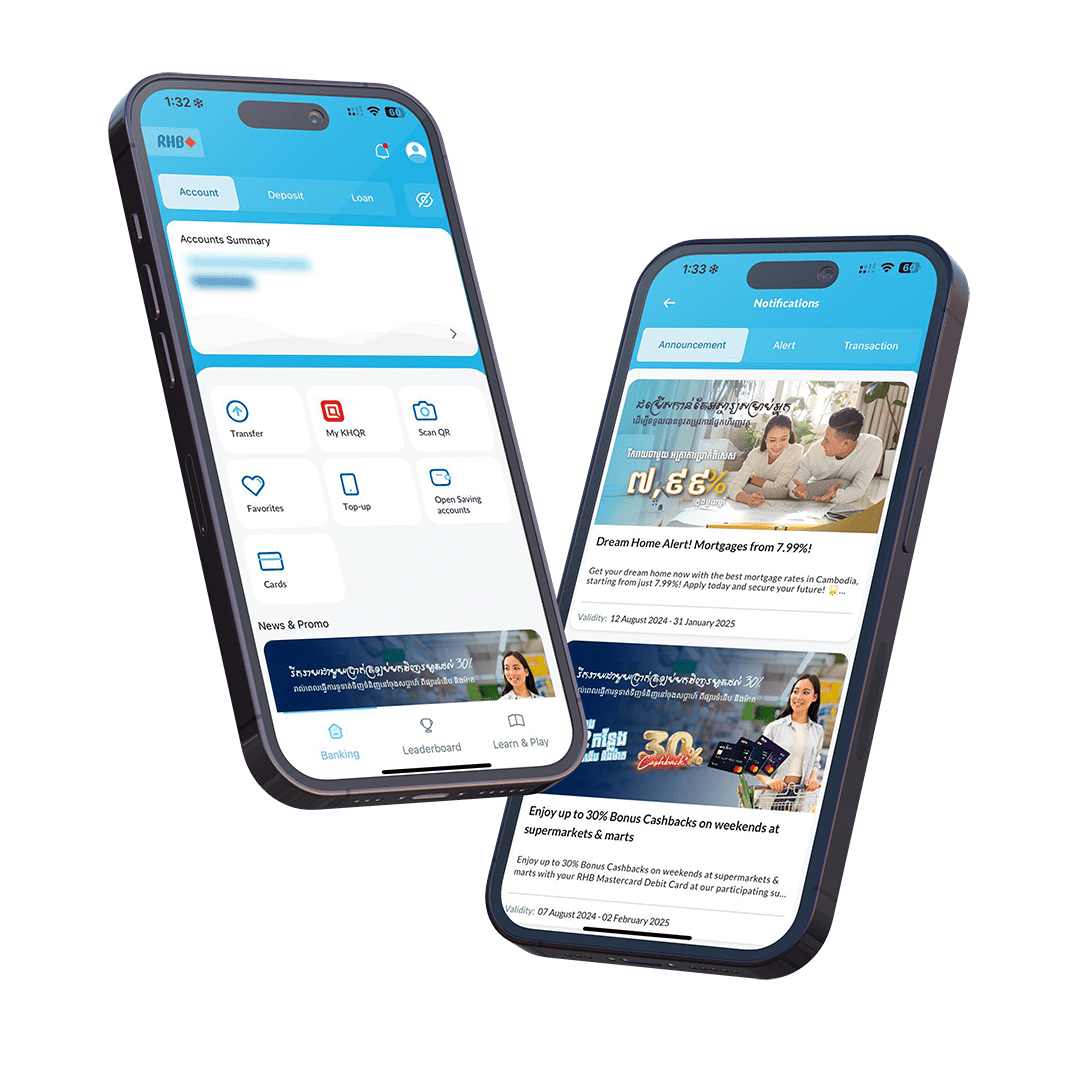

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!