Teaching our kids to save money is a valuable step towards good financial management, but it shouldn’t stop there. While opening a savings account is the safest and most reliable way they could make money, investing their hard-earned cash would give them real earning power. We should start teaching them investment because our kids have the most valuable gift — time. The sooner our children start investing their money, the more profit they’d make. Here are some ways you can introduce them to investment.

Work together with your children to select a company that has products and services they understand and use. Encourage them to research and learn about different companies. Discuss current performance and how it might evolve in the future.

Encourage teens to invest and hold their investments over time. Most successful investors use the “buy and hold” strategy. Share stories and books about Warren Buffett, Peter Lynch, and other long-term investors to inspire them.

Let them start with a small amount to gain experience and learn from their decisions without risking much. Fractional shares are a great way to reduce the barrier of entry and minimize risk.

Let your teens invest in companies or causes they care about. They’ll be more interested and engaged when they have a personal connection to the business.

Encourage your children to invest a portion of any income—be it allowance, gift money, or part-time earnings. Developing this habit early helps them build long-term financial discipline and confidence.

Do you find these tips resourceful? We hope these methods encourage you to introduce investing to your children and support them in developing strong financial foundations for the future.

Teaching our kids to save money is a valuable step towards good financial management, but it shouldn’t stop there. While opening a savings account is the safest and most reliable way they could make money, investing their hard-earned cash would give them real earning power. We should start teaching them investment because our kids have the most valuable gift — time. The sooner our children start investing their money, the more profit they’d make. Here are some ways you can introduce them to investment.

Work together with your children to select a company that has products and services they understand and use. Encourage them to research and learn about different companies. Discuss current performance and how it might evolve in the future.

Encourage teens to invest and hold their investments over time. Most successful investors use the “buy and hold” strategy. Share stories and books about Warren Buffett, Peter Lynch, and other long-term investors to inspire them.

Let them start with a small amount to gain experience and learn from their decisions without risking much. Fractional shares are a great way to reduce the barrier of entry and minimize risk.

Let your teens invest in companies or causes they care about. They’ll be more interested and engaged when they have a personal connection to the business.

Encourage your children to invest a portion of any income—be it allowance, gift money, or part-time earnings. Developing this habit early helps them build long-term financial discipline and confidence.

Do you find these tips resourceful? We hope these methods encourage you to introduce investing to your children and support them in developing strong financial foundations for the future.

Teaching our kids to save money is a valuable step towards good financial management, but it shouldn’t stop there. While opening a savings account is the safest and most reliable way they could make money, investing their hard-earned cash would give them real earning power. We should start teaching them investment because our kids have the most valuable gift — time. The sooner our children start investing their money, the more profit they’d make. Here are some ways you can introduce them to investment.

Work together with your children to select a company that has products and services they understand and use. Encourage them to research and learn about different companies. Discuss current performance and how it might evolve in the future.

Encourage teens to invest and hold their investments over time. Most successful investors use the “buy and hold” strategy. Share stories and books about Warren Buffett, Peter Lynch, and other long-term investors to inspire them.

Let them start with a small amount to gain experience and learn from their decisions without risking much. Fractional shares are a great way to reduce the barrier of entry and minimize risk.

Let your teens invest in companies or causes they care about. They’ll be more interested and engaged when they have a personal connection to the business.

Encourage your children to invest a portion of any income—be it allowance, gift money, or part-time earnings. Developing this habit early helps them build long-term financial discipline and confidence.

Do you find these tips resourceful? We hope these methods encourage you to introduce investing to your children and support them in developing strong financial foundations for the future.

Teaching our kids to save money is a valuable step towards good financial management, but it shouldn’t stop there. While opening a savings account is the safest and most reliable way they could make money, investing their hard-earned cash would give them real earning power. We should start teaching them investment because our kids have the most valuable gift — time. The sooner our children start investing their money, the more profit they’d make. Here are some ways you can introduce them to investment.

Work together with your children to select a company that has products and services they understand and use. Encourage them to research and learn about different companies. Discuss current performance and how it might evolve in the future.

Encourage teens to invest and hold their investments over time. Most successful investors use the “buy and hold” strategy. Share stories and books about Warren Buffett, Peter Lynch, and other long-term investors to inspire them.

Let them start with a small amount to gain experience and learn from their decisions without risking much. Fractional shares are a great way to reduce the barrier of entry and minimize risk.

Let your teens invest in companies or causes they care about. They’ll be more interested and engaged when they have a personal connection to the business.

Encourage your children to invest a portion of any income—be it allowance, gift money, or part-time earnings. Developing this habit early helps them build long-term financial discipline and confidence.

Do you find these tips resourceful? We hope these methods encourage you to introduce investing to your children and support them in developing strong financial foundations for the future.

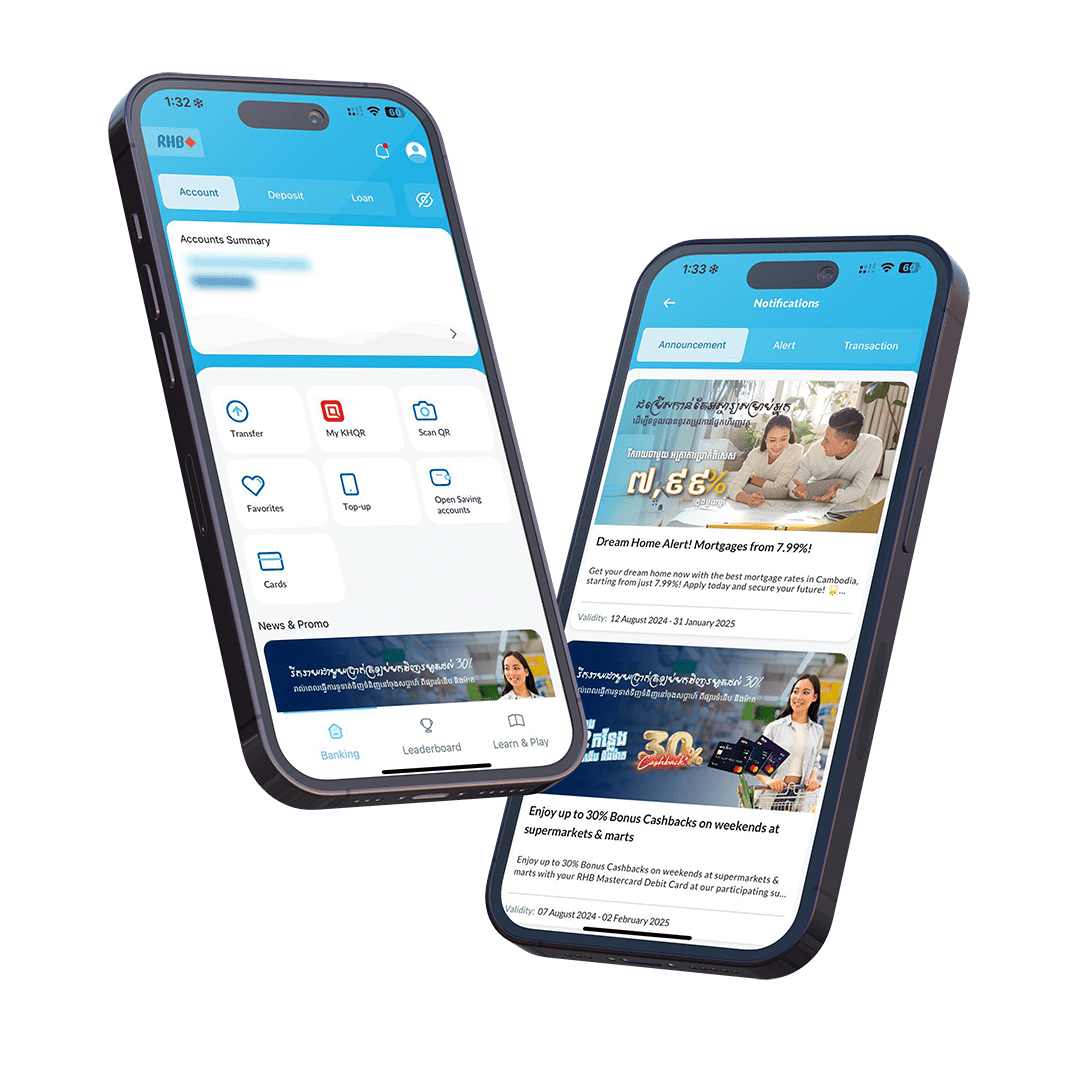

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!