As university students, we spend most of our time eating, studying and, occasionally, having fun. What we may not have thought of, is that they all cost money! If we want to do all those without breaking the bank by the first week of every month with our slim budget, we need to be smart in the way we spend our money. Good financial management is a key to a successful life beyond graduation and into adulthood. On top of setting your regular budgets, below are 5 tricks to help you get started with your saving goals this year.

Rather than making impulse purchases that you may regret later, add them to your wish list and set saving goals for these purchases. When you save up, you can revisit these lists to decide whether you REALLY want it. Have a shopping list before you go shopping and stick to buying only what is on the list.

Always bring your Student ID and ask for discounts. Many shops offer special discounts for students if they have their Student ID as proof. If you have a wallet to carry cash and a credit card for buying stuff, you should bring your Student ID for a discount too!

Who doesn’t know that student life is busy? From pulling all-nighters to meet assignment deadlines to having to wake up for that 8 AM class, coffee becomes your best friend. But if you can be your own barista, you can save 3–5 dollars every morning. That way, you can save around 1000 to 2000 dollars each year! Same goes for drinking water brought from home. Those bottled waters are convenient, but the cost adds up surprisingly fast.

Mobile apps such as Money Lover and Fortune City let you easily record and manage your spending. You just need to allocate a few minutes per day to note things down and get into the habit of recording. Keeping track of where your money is going helps you plan your saving goals more effectively.

Once you have a clear budget and saving goals, it is time to put your money to work. Many banks offer this service, and you can passively earn some money from saving your money this way.

As university students, we spend most of our time eating, studying and, occasionally, having fun. What we may not have thought of, is that they all cost money! If we want to do all those without breaking the bank by the first week of every month with our slim budget, we need to be smart in the way we spend our money. Good financial management is a key to a successful life beyond graduation and into adulthood. On top of setting your regular budgets, below are 5 tricks to help you get started with your saving goals this year.

Rather than making impulse purchases that you may regret later, add them to your wish list and set saving goals for these purchases. When you save up, you can revisit these lists to decide whether you REALLY want it. Have a shopping list before you go shopping and stick to buying only what is on the list.

Always bring your Student ID and ask for discounts. Many shops offer special discounts for students if they have their Student ID as proof. If you have a wallet to carry cash and a credit card for buying stuff, you should bring your Student ID for a discount too!

Who doesn’t know that student life is busy? From pulling all-nighters to meet assignment deadlines to having to wake up for that 8 AM class, coffee becomes your best friend. But if you can be your own barista, you can save 3–5 dollars every morning. That way, you can save around 1000 to 2000 dollars each year! Same goes for drinking water brought from home. Those bottled waters are convenient, but the cost adds up surprisingly fast.

Mobile apps such as Money Lover and Fortune City let you easily record and manage your spending. You just need to allocate a few minutes per day to note things down and get into the habit of recording. Keeping track of where your money is going helps you plan your saving goals more effectively.

Once you have a clear budget and saving goals, it is time to put your money to work. Many banks offer this service, and you can passively earn some money from saving your money this way.

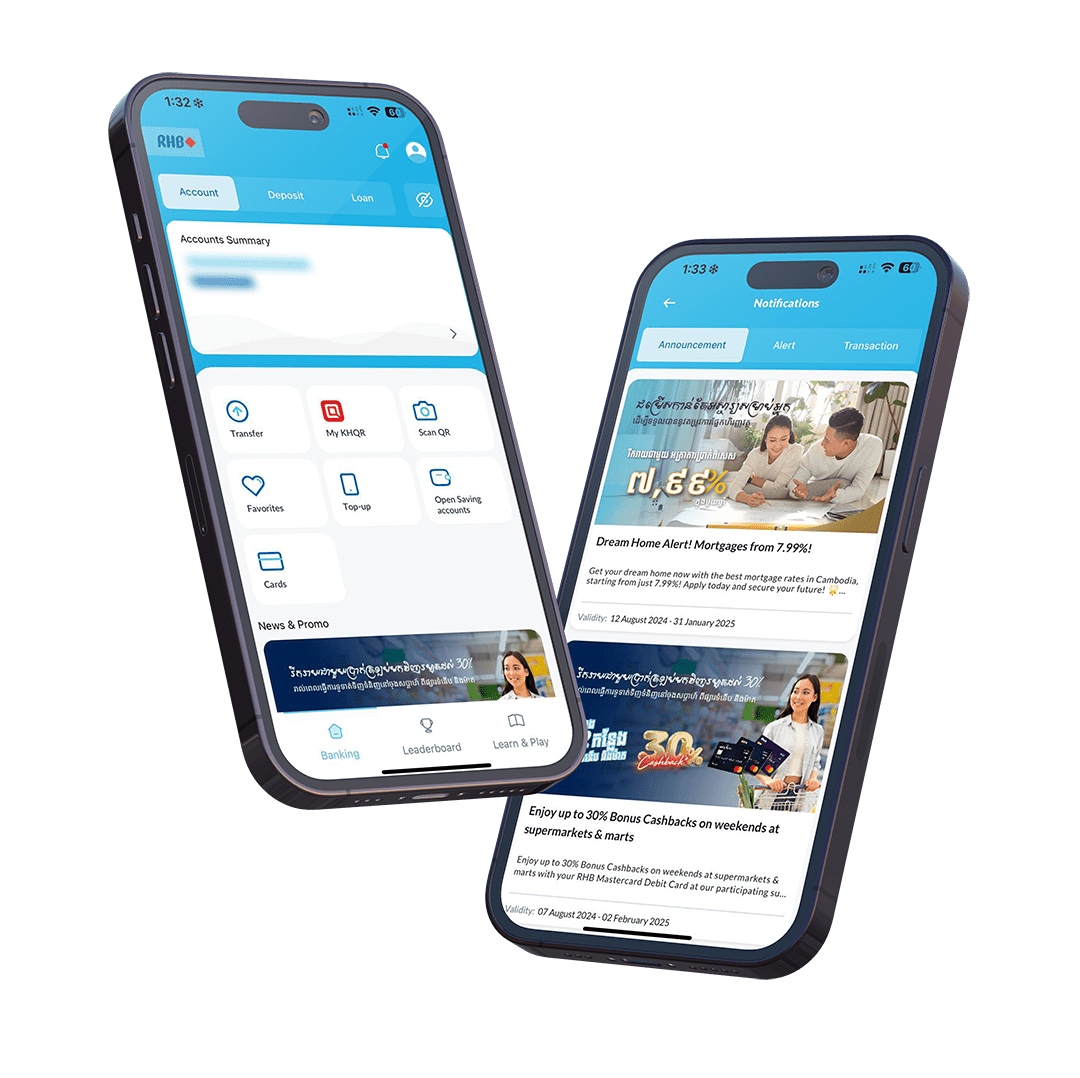

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!

As university students, we spend most of our time eating, studying and, occasionally, having fun. What we may not have thought of, is that they all cost money! If we want to do all those without breaking the bank by the first week of every month with our slim budget, we need to be smart in the way we spend our money. Good financial management is a key to a successful life beyond graduation and into adulthood. On top of setting your regular budgets, below are 5 tricks to help you get started with your saving goals this year.

Rather than making impulse purchases that you may regret later, add them to your wish list and set saving goals for these purchases. When you save up, you can revisit these lists to decide whether you REALLY want it. Have a shopping list before you go shopping and stick to buying only what is on the list.

Always bring your Student ID and ask for discounts. Many shops offer special discounts for students if they have their Student ID as proof. If you have a wallet to carry cash and a credit card for buying stuff, you should bring your Student ID for a discount too!

Who doesn’t know that student life is busy? From pulling all-nighters to meet assignment deadlines to having to wake up for that 8 AM class, coffee becomes your best friend. But if you can be your own barista, you can save 3–5 dollars every morning. That way, you can save around 1000 to 2000 dollars each year! Same goes for drinking water brought from home. Those bottled waters are convenient, but the cost adds up surprisingly fast.

Mobile apps such as Money Lover and Fortune City let you easily record and manage your spending. You just need to allocate a few minutes per day to note things down and get into the habit of recording. Keeping track of where your money is going helps you plan your saving goals more effectively.

Once you have a clear budget and saving goals, it is time to put your money to work. Many banks offer this service, and you can passively earn some money from saving your money this way.

As university students, we spend most of our time eating, studying and, occasionally, having fun. What we may not have thought of, is that they all cost money! If we want to do all those without breaking the bank by the first week of every month with our slim budget, we need to be smart in the way we spend our money. Good financial management is a key to a successful life beyond graduation and into adulthood. On top of setting your regular budgets, below are 5 tricks to help you get started with your saving goals this year.

Rather than making impulse purchases that you may regret later, add them to your wish list and set saving goals for these purchases. When you save up, you can revisit these lists to decide whether you REALLY want it. Have a shopping list before you go shopping and stick to buying only what is on the list.

Always bring your Student ID and ask for discounts. Many shops offer special discounts for students if they have their Student ID as proof. If you have a wallet to carry cash and a credit card for buying stuff, you should bring your Student ID for a discount too!

Who doesn’t know that student life is busy? From pulling all-nighters to meet assignment deadlines to having to wake up for that 8 AM class, coffee becomes your best friend. But if you can be your own barista, you can save 3–5 dollars every morning. That way, you can save around 1000 to 2000 dollars each year! Same goes for drinking water brought from home. Those bottled waters are convenient, but the cost adds up surprisingly fast.

Mobile apps such as Money Lover and Fortune City let you easily record and manage your spending. You just need to allocate a few minutes per day to note things down and get into the habit of recording. Keeping track of where your money is going helps you plan your saving goals more effectively.

Once you have a clear budget and saving goals, it is time to put your money to work. Many banks offer this service, and you can passively earn some money from saving your money this way.

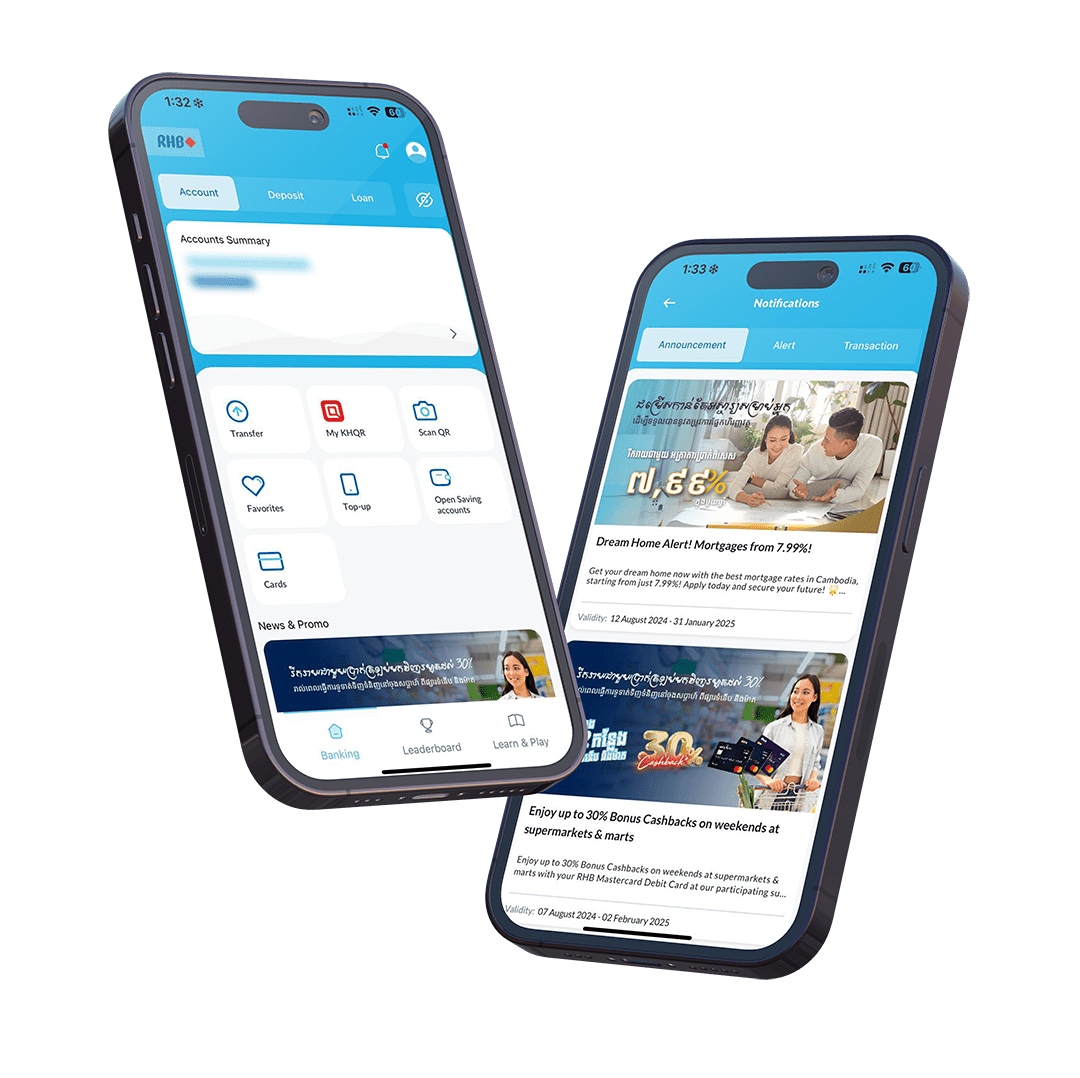

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!