Buying a new home is exciting, but when you still own your current property, the process can feel complicated—especially if you’re worried about timing, financing, or carrying two mortgages at once. The good news? Many homeowners successfully buy first and sell later. With the right strategy, you can make the transition smooth, secure, and financially manageable.

If you’ve built up equity in your current home, a home equity loan or Home Equity Line of Credit (HELOC) can give you the funds needed for your next purchase.

How It Helps

* Provides cash for a down payment or closing costs

* Lets you act fast in competitive markets

* Offers flexible repayment terms (especially with a HELOC)

Considerations

* You must qualify while still carrying your current mortgage

* You’ll be paying two loans until the first home sells

* Best for homeowners with strong credit and plenty of equity

A bridge loan is a short‑term financing option designed specifically for buying before selling. It “bridges” the gap between the sale of your old home and the purchase of your new one.

How It Helps

* Gives you immediate access to cash

* Can cover your down payment or even pay off your existing mortgage

* Usually repaid once your current home sells

Considerations

* Higher interest rates

* Short repayment periods (6–12 months)

* Requires good credit and solid financial profile

With a home sale contingency, you make an offer on a new home that depends on selling your current property first.

How It Helps

* Reduces financial risk

* Gives you time to market and sell your home

Considerations

* Less attractive to sellers—especially in a hot market

* You may miss out on homes with strong competition

Contingent offers are best in buyer-friendly markets where sellers are more flexible.

If your finances allow it—or you’re open to becoming a landlord—renting out your current property can help cover its mortgage while you move into your new home.

How It Helps

* Generates income to offset your current mortgage

* Allows you to buy your next home without selling immediately

* Helps you build long-term wealth through real estate

Considerations

* Responsibility of being a landlord

* You may need rental agreements in place for lenders to count rental income

* Potential vacancy periods

Several companies and real estate services now offer “buy before you sell” programs. They can purchase your new home in cash on your behalf, then sell your old home, and transfer the new home to you.

How It Helps

* Allows you to make competitive cash offers

* Eliminates the pressure of coordinating closing dates

* Provides professional support during the transition

Considerations

* Program fees vary

* Not available in all regions

* Terms depend on the company’s policy

This is a great option if you want certainty and convenience.

Final Thoughts

Buying a new home before selling your current one doesn’t have to be stressful. Whether you use your equity, a short‑term loan, a contingency, rental income, or a buy-before-you-sell program, the key is choosing the strategy that matches your finances, local market conditions, and comfort level.

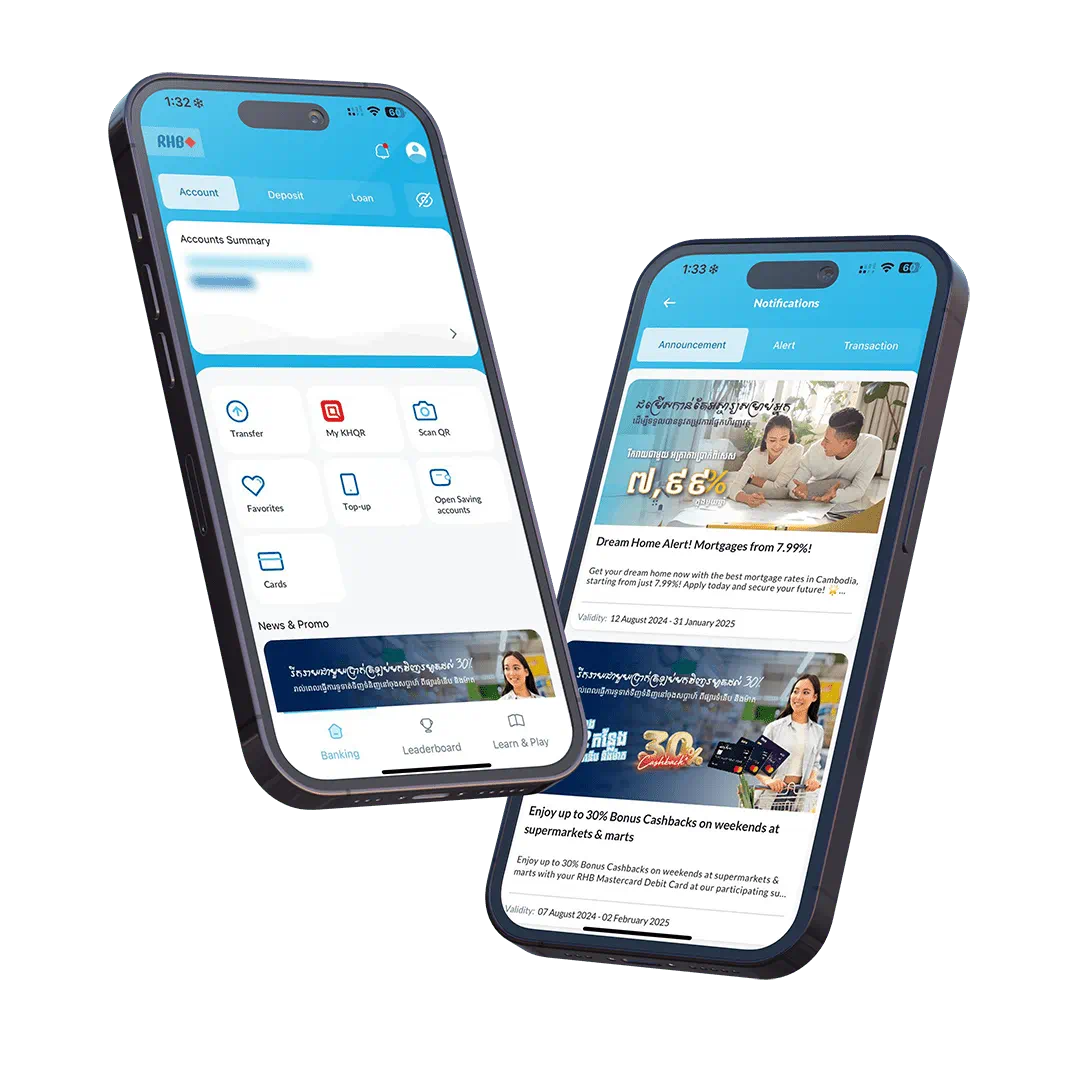

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!