Investment sounds scary, but the truth is, you can even start to invest when you begin your first job! Here are some tips before you dive into investing.

Education is important when you want to start your investment journey. Most people tend to only go for big, reputable companies, which is normally not a bad idea. However, it’s always wiser to do a bit of research before you put your money in. Try not to put all your eggs in one basket just because you saw it online or heard it from a friend. It’s your hard-earned money after all!

Normally, we want to pay off our debts before we start spending. However, did you know most student loans have lower interest than other loans? With the right investment strategy, you might even repay it using your investment returns!

You may not need millions to begin your investment, but you should set a budget for emergencies before starting. Have at least some cash buffer in your savings, and then divide your funds between saving and investing.

Start by investing in yourself! If you’re not working in a government body, you can open a retirement account at a reliable bank. Start depositing early—your future self will thank you!

What’s your thought now about investing?

Investment sounds scary, but the truth is, you can even start to invest when you begin your first job! Here are some tips before you dive into investing.

Education is important when you want to start your investment journey. Most people tend to only go for big, reputable companies, which is normally not a bad idea. However, it’s always wiser to do a bit of research before you put your money in. Try not to put all your eggs in one basket just because you saw it online or heard it from a friend. It’s your hard-earned money after all!

Normally, we want to pay off our debts before we start spending. However, did you know most student loans have lower interest than other loans? With the right investment strategy, you might even repay it using your investment returns!

You may not need millions to begin your investment, but you should set a budget for emergencies before starting. Have at least some cash buffer in your savings, and then divide your funds between saving and investing.

Start by investing in yourself! If you’re not working in a government body, you can open a retirement account at a reliable bank. Start depositing early—your future self will thank you!

What’s your thought now about investing?

Investment sounds scary, but the truth is, you can even start to invest when you begin your first job! Here are some tips before you dive into investing.

Education is important when you want to start your investment journey. Most people tend to only go for big, reputable companies, which is normally not a bad idea. However, it’s always wiser to do a bit of research before you put your money in. Try not to put all your eggs in one basket just because you saw it online or heard it from a friend. It’s your hard-earned money after all!

Normally, we want to pay off our debts before we start spending. However, did you know most student loans have lower interest than other loans? With the right investment strategy, you might even repay it using your investment returns!

You may not need millions to begin your investment, but you should set a budget for emergencies before starting. Have at least some cash buffer in your savings, and then divide your funds between saving and investing.

Start by investing in yourself! If you’re not working in a government body, you can open a retirement account at a reliable bank. Start depositing early—your future self will thank you!

What’s your thought now about investing?

Investment sounds scary, but the truth is, you can even start to invest when you begin your first job! Here are some tips before you dive into investing.

Education is important when you want to start your investment journey. Most people tend to only go for big, reputable companies, which is normally not a bad idea. However, it’s always wiser to do a bit of research before you put your money in. Try not to put all your eggs in one basket just because you saw it online or heard it from a friend. It’s your hard-earned money after all!

Normally, we want to pay off our debts before we start spending. However, did you know most student loans have lower interest than other loans? With the right investment strategy, you might even repay it using your investment returns!

You may not need millions to begin your investment, but you should set a budget for emergencies before starting. Have at least some cash buffer in your savings, and then divide your funds between saving and investing.

Start by investing in yourself! If you’re not working in a government body, you can open a retirement account at a reliable bank. Start depositing early—your future self will thank you!

What’s your thought now about investing?

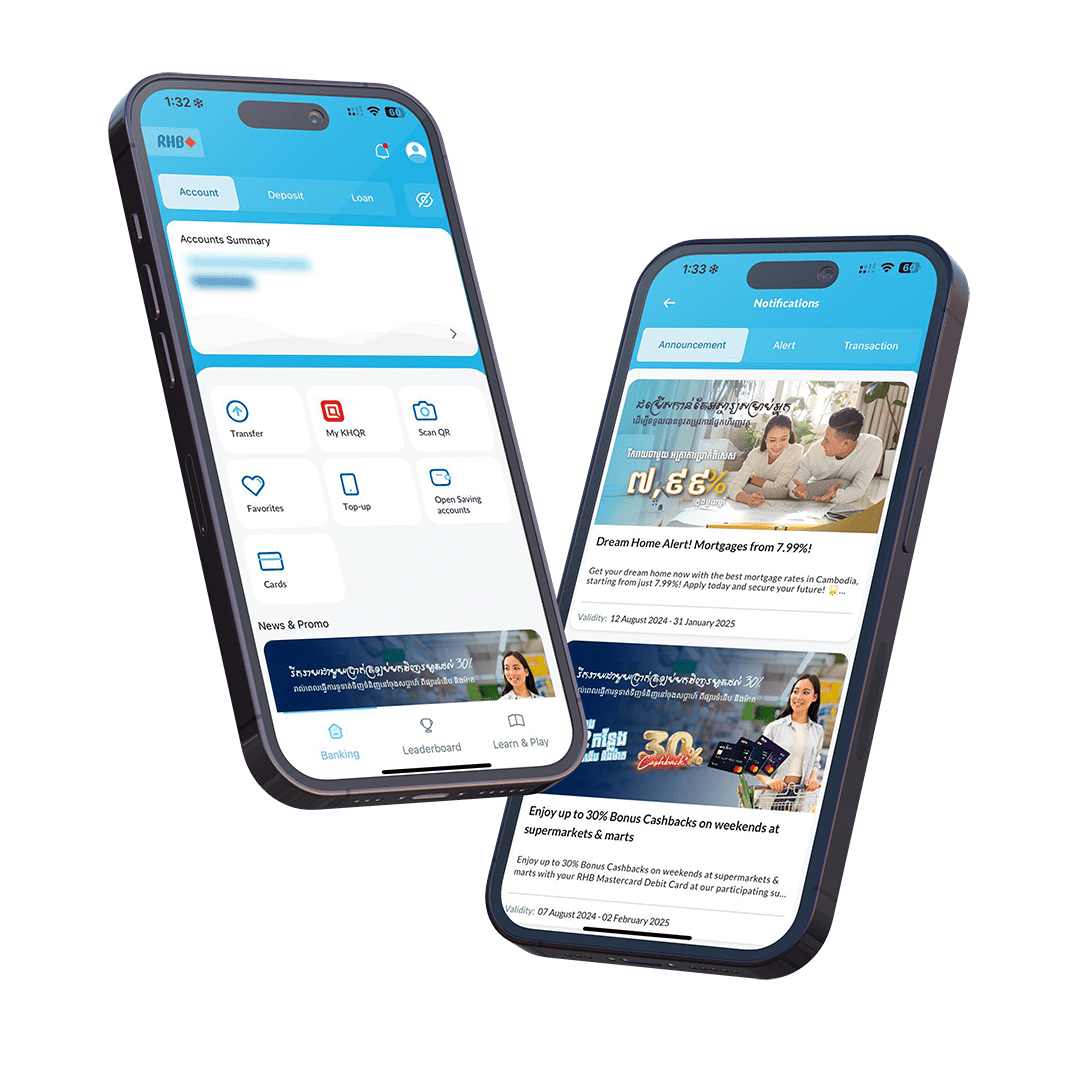

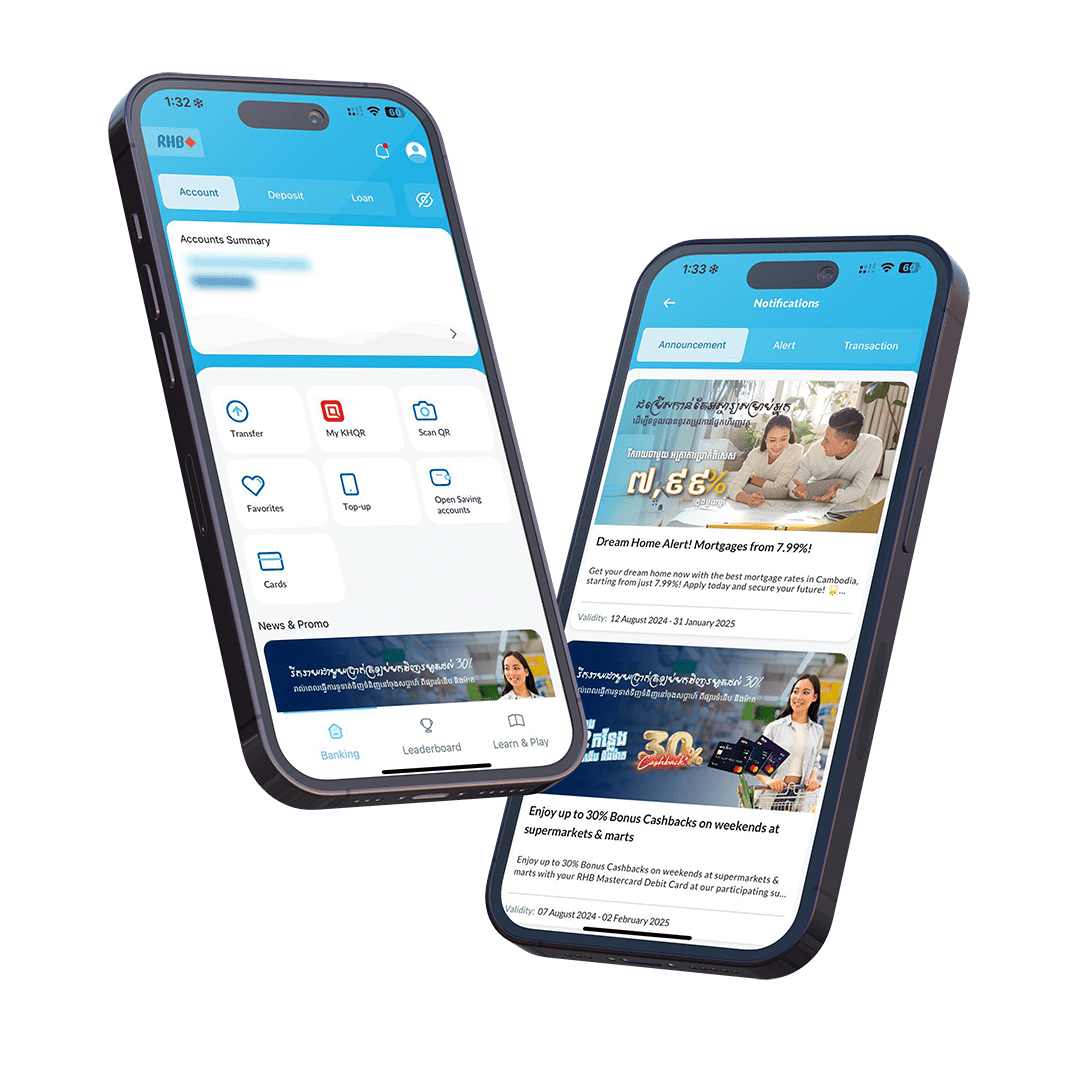

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!

is Mobile Banking App that allows you to access and manage your bank accounts from your smartphone. Besides Banking features, It can help you to give financial tips and tricks, save money while having fun, do more, and spend less time worrying about complicated financial things!